The evolution of streaming ads - and how they can still surprise you

The year is 2017, the place, a tech savvy millennial’s living room. As she blissfully streams her favorite Netflix episodes, she has no idea that in just three years, a global pandemic is about to change everything and revolutionize the way television viewers consume content forever.

That’s right: although streaming devices were already making market inroads in the mid-2010s, nothing could have prepared the industry for the meteoric rise of on-demand streaming brought on by global lockdowns in 2020 and beyond.

Even today, CTV advertising demand and shifting consumer needs continue to defy market predictions from just a few months ago!

As a new year begins, we decided to take a look back at the evolution of CTV and CTV advertising over time to help our clients gain some clarity on the true scope of streamed advertising and the exciting opportunities that lie ahead! Let’s dive in.

Where it all started

Tracing the beginning of streamed television advertising is complex from the get go, because it relates to the birth of linear television advertising - some odd 80 years ago(!) - and the early days of digital advertising, but let’s give it a shot.

The first US television commercials aired on just 10 stations in 1941. Fourteen years later, television advertising spend had already reached the $1B mark. From then on, the TV advertising industry evolved rapidly, developing different value tiers like primetime slots and event sponsorships that reached vast amounts of viewers with the impact of large screen, full color TV. For advertisers, the payoff was clear, but so was the cost: only the most established Fortune 500 companies can now afford to “spray and pray” that their campaigns will reach the right audiences at the right time.

Meanwhile, far from Madison Ave ad agencies, the first-ever online ad was posted on October 27th, 1994, by a precursor to today's tech site, Wired. And so began online advertising, opening up a new screen for marketers to engage with brand new audiences, and kick starting the wild ride that is today’s digital landscape.

Interestingly, while the digital ads ecosystem evolved quickly, linear TV remained separate and largely unchanged – until the introduction of CTV in 2007, which brings us back to where we started this article: a global pandemic that disrupted every social and commercial mechanism one could imagine, including a profound shift in media consumption.

As of 2022, 92% of households were reachable by CTV programmatic advertising and CTV advertising spend exceeded $50 billion by the end of 2022. That number is only forecast to grow as we enter into the 2023 planning season. And just as paid search rapidly went from unwieldy tech trick to ubiquitous advertising tool, OTT networks have grown exponentially with accompanying advertisement technologies following suit.

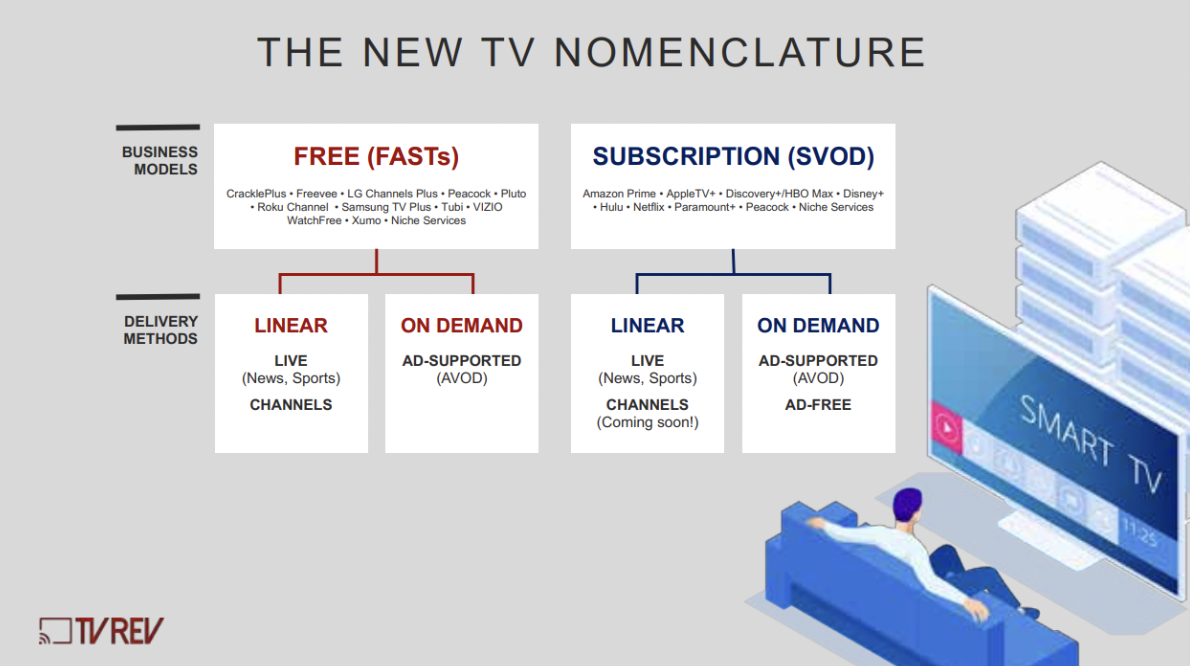

A cursory glance at the last three years makes this growth unmistakably clear. While one could argue that Hulu, Netflix and Amazon Prime have been around for over a decade, 2021 brought a tremendous wave of new players who all follow a very different playbook. Today, new OTT providers are reworking the SVOD model in favor of FAST(Free Ad Supported Television) programming, largely at the behest of stretched thin viewers who refuse to pay for more than two or three CTV subscriptions at a time.

While it may be tempting to point out that Netflix and Amazon are still the most recognizable names in the streaming world, viewership numbers paint a different picture: according to Deloitte, 67% of consumers have a paid TV subscription, but a whopping 92% streamed programming last year. How to explain the difference? FAST channels. So while experts initially predicted a slowing down of streamed content consumption after the pandemic, they were proven wrong as viewers didn’t stop watching TV - they just changed the channels they were watching.

CTV defies industry predictions again!

How it works and what all those acronyms mean

In a nutshell (and at its best) CTV advertising promises the best of television advertising - unskippable, sight, sound, and motion ads on a centrally located big screen - with the flexible targeting capabilities of digital marketing. Privacy-compliant first-party data usage, especially, helps CTV stand out as compared to linear television. Think of it this way: CTV basically offers a double engagement whammy because a) most streamed content is on-demand, which means viewers are hyper-focused, and b) programmatic CTV offers a scaled and addressable advertising ecosystem without third-party cookies. It’s a new privacy compliant paradigm, beyond a powerful digital engine.

That means marketers can now reach user segments that were only previously available to digital giants, cutting out one of the big headwinds facing linear TV for many years - the dreaded “wasted impressions” - and allowing marketers to optimize ROI.

Now before going too much further into the various components and strategies of streamed advertising, it’s important to recognize that the CTV ecosystem encompasses a wide variety of monetization and programming models that can be leveraged in different ways, for different types of strategies and budgets. Let’s take a closer look.

SVOD (Subscription-based Video On Demand) services were probably the first CTV services most of us became familiar with, and their initial monetization strategy was decidedly focused on subscriber revenue, capitalizing on a binge-friendly on-demand model, with no ad slots.

In a clear sign that streamed advertising is the way of the future, however, all three major SVOD providers (Netflix, Disney +, and Amazon Prime) have announced the introduction of ad-supported tiers this year. While working with these types of platforms will certainly be intriguing for higher budget campaigns, their astronomical average CPMs and private deal-only sales policies will limit their appeal for non F500 companies.

Meanwhile, as mentioned above, the FAST model is 100% ad-supported, across both linear and on-demand, and growing exponentially as OTT providers like Roku allow users to search for content “agnostically,” across streaming platforms (as opposed to earlier use cases where viewers had to log into a specific platform before searching for their content). Working programmatically across hundreds of FAST channels helps advertisers scale at any budget - and now they finally have enough viewers for a FAST-first CTV strategy to make an impact!

Beyond these two main categories, there are also a variety of ways in which deals can be made. Here’s how CTV buying works:

- Some inventory is sold directly by the programmer or aggregator. That means advertisers would contact Fubo or Tubi or Hulu directly to make a specific ad deal exclusively for that channel.

- But much (if not most) is sold via some manner of automated (programmatic) buying platform (like Vibe.co). “Some manner” because there are multiple types of programmatic buying platforms: private marketplaces, guaranteed programmatic and open programmatic options. These types of deals allow marketers to scale their campaigns massively and maintain flexible budgets that can respond to relevant market forces in real time.

A platform like Vibe.co, for example, works with 600+ streaming channels, bidding programmatically for ad space on some or all of those channels in real-time, within the limits of any campaign budget, and targeting only the specific users that fit that campaign’s goals.

How are streaming ads trending today?

Beyond internal disagreements on specifics, it remains clear at this point that CTV is a runaway success. Yep, the people have spoken, and although measurement standardization remains a work in progress, a recent IAB survey’s results were incontrovertible: CTV’s targetability, flexibility, high quality content, and brand safety are hugely attractive to marketers across industries.

In fact, it showed up in the nick of time, as global digital privacy regulations reach a historical inflection point. Over the past year, GDPR, cookie deprecation, and other ATTs have led to catastrophic (or at the very least, very expensive) signal loss for digital marketers dealing with increasingly unreliable targeting on performance-specific platforms not made for broader brand plays.

CTV advertising platforms, on the other hand, are creating device maps by associating individual connected devices to a household IP address, then taking deterministic data such as location, logins, email addresses, app downloads, online and offline purchases, memberships, etc. to create accurate and relevant audience profiles in a privacy compliant manner.

On Vibe.co, for example, users can target audiences by demographic, location, interest, income level, channel, and more so that smaller brands can focus on the markets they can afford to target and larger ones can incrementally reach those valuable cord cutters they can’t find on linear television anymore.

Furthermore, programmatic technology and targeting data now enable advertisers to truly understand what percentage of their TV ad budget is delivering ROI, and this level of granularity is starting to attract not only traditional TV advertisers to CTV but those historically absent from TV ad buys altogether.

Meanwhile, greater targeting leads to the holy grail of performance marketing: customization. According to a recent Google study, consumers expect it and advertisers (with the right distribution partners) are happy to oblige. If 66% of consumers report that it’s important to have a personalized experience and 76% of users report that a personalized engagement with a brand prompted consideration of a purchase, marketing budgets need to prioritize tools with customization at their core.

Feel overwhelming? Don’t fret. Most customization is as simple as location-specific overlays on your ad creative, or different promo code voiceovers, easily distributed to relevant audiences through multivariate campaigns that segment campaigns into ad sets in a matter of minutes. And the results are well worth the effort, especially because real-time results will also be segmented, providing granular insights into each audience subset.

Once all is said and done, however, industry experts continue to scratch their heads at the low CTV adoption rate for smaller brands and businesses. Despite the ease, affordability, and scale of programmatic CTV advertising, most advertisers actually leveraging this technology are legacy television advertisers. One of the most interesting aspects of the evolution of CTV, at this point, is the reticence digital-first advertisers still have towards it, especially in light of its growing potential: the first movers will get the most benefit from this powerful format and capitalize on incremental reach. Says Aaron Grote, senior director of identity and attribution products at Stirista: “This is a unique and short-lived moment where first movers really can build a mental moat around their brand in consumers’ minds.”

Where is streaming headed?

The main concerns for CTV advertisers and advertising platforms today are, unequivocally, measurement and scale; but the industry is already growing in exciting ways on both fronts. While measurement standardization is clearly an issue that needs to be urgently addressed (and is, by some of the best in the biz), it’s already helpful to expand the way advertisers think about engaging with consumers on television.

Consider, for example, the concept of “dual screening,” which posits that advertisers should account for their viewers always having a 2nd device in their hand (mobile, tablet, desktop) as they watch their ad, and tailor their calls to action to reflect that reality. In fact, our partners at MMP Adjust recently reported that 85% of consumers report using second devices such as smartphones or tablets while watching television, especially now that most OTT providers can use phones as remote controls.

While on the subject of dual screening, it is absolutely essential to remember that CTV users stream content on a wide variety of devices, at rates many advertisers still haven’t quite wrapped their heads around yet. They watch TVs, of course, but also phones, tablets, laptops, and gaming consoles (the average U.S. household has 22 connected devices!!), all linked to the home IP address CTV ad platforms use for targeting.

What does that mean? It’s simple, really: more devices = more data, and more data = more precisely targeted ads and agile campaigns. In a recent interview, VIZIO Group Vice President, Travis Hockersmith explained the advantages of data-backed campaign agility: “We have a variety of advertisers who are looking at brand health metrics as their primary metrics for a campaign. And we have a lot of ways that we can measure brand health. We also have some advertisers who already have a lot of good data on how well their ads work at certain reach and frequency levels. And what we can do for them is help them achieve those reach and frequency levels by targeting viewers who are underexposed to the ad. So depending on the KPIs for any particular client, be it a performance advertiser or brand advertiser, we have a lot of good solutions, and a lot of good data that helps us guide those solutions.”

Which brings us back to the original CTV boogeyman: measurement. In this case, let’s focus on two interesting ways the industry is shifting perspectives on the issue.

First, is the concept of “assisted value” which Adjust’s Director of Connected TV and New Channels, Gijsbert Pols, often writes so eloquently about: “While channels like paid search can be good at attributing conversions to themselves, often the incrementality of those conversions is low, which means you aren’t getting very much actual growth for that dollar. This manifests itself as positive-looking marketing dashboards, but less positive company-level metrics.” It’s more important to take a holistic approach to results, in which case marketers have been noticing sales and lead lifts across channels, once CTV was added to their marketing mix.

Second, is the “performance feedback loop” that tracking tools like pixels, MMPs, and Google integrations are bringing to the picture. Advertisers can now track which user segments visited their websites most after a CTV ad exposure, for example, or which channels are garnering the most views, which creative led to the most app installs, which demographics have the highest VTR (View Through Rates), and more, in real time.

Ultimately, at this point in the CTV ad journey - whether we’re focusing on scale, customization, or data-led optimization - it is absolutely vital to buy across multiple platforms, in order to garner actionable results, which can be very difficult.

That’s where a programmatic CTV ad partner like Vibe.co comes in. The Vibe.co dream is, and always has been, to facilitate TV access for a much broader advertiser base, thanks to an easy-to-use platform, 600+ channel inventory, and performance-focused reporting. And we’re well on our way: big brands that spend hundreds of millions of dollars on TV and local advertisers that have always relied on the medium’s ability to target their user base are increasingly joined by smaller brands—DTC brands in particular—that can finally afford TV due to streaming’s ability to target ads to very specific audiences. Join us!